Never lose track of your credit score payments personal data verification

With the Checkboard app you can simply and securely verify your identity, confirm your financial health, and get a clear picture of your credit and payments.

You’ve got the Checkboard app.

Now what?

Checkboard is the fast and secure way for you to confirm to your estate agent or conveyancer you are who you say you are – so you can get hold of the keys to your new property sooner.

ID verification

Verify your ID with smart biometrics

Simply upload an image of your passport and Checkboard will use biometric identification to match your face to your name – and confirm you are who you say you are.

For your estate agent, this means they’re meeting their obligations towards the regulators. And for you, it means you’re one step closer to closing the deal and moving in to your new place.

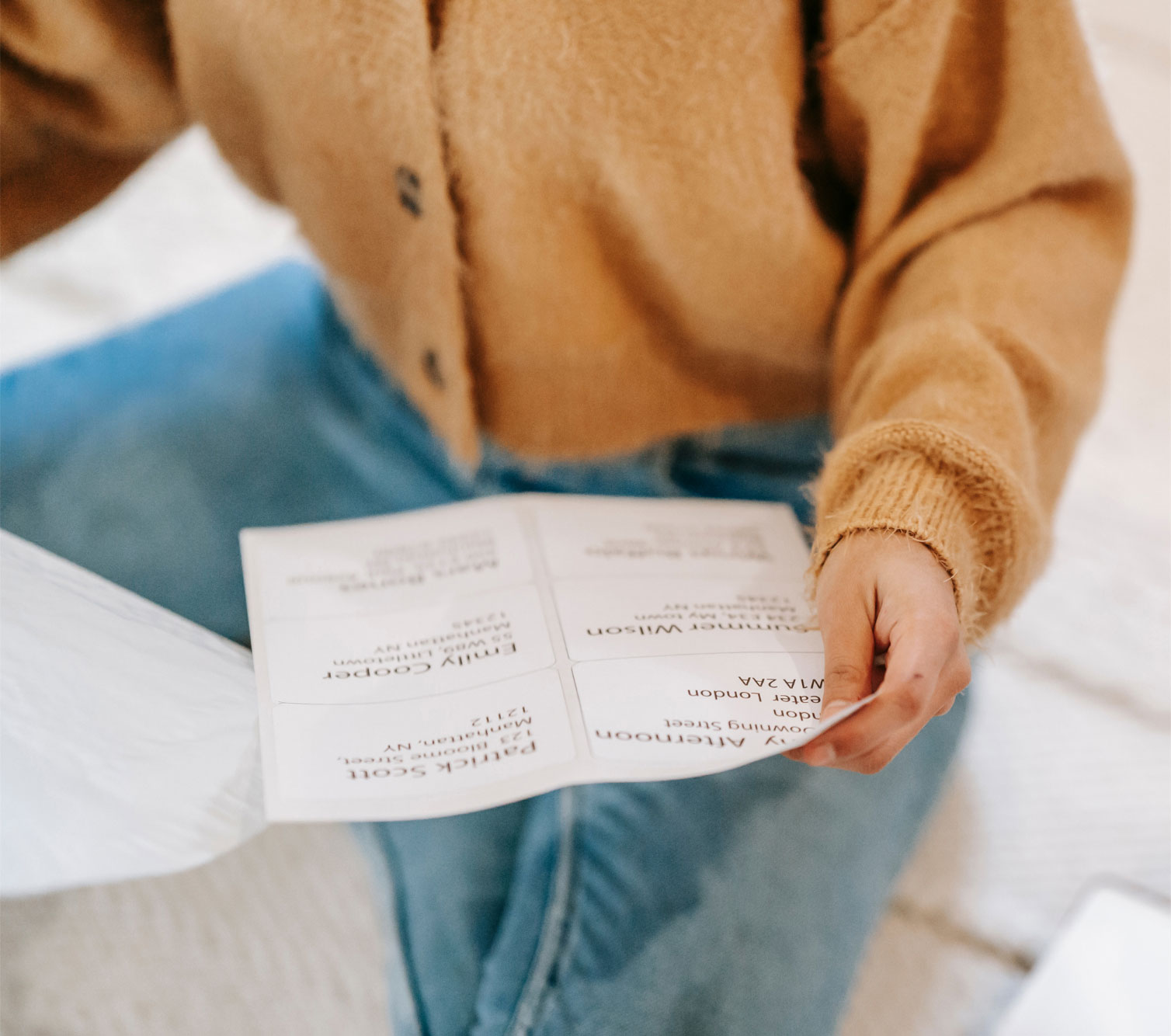

Proof of address

Confirm your address in one click

Checkboard makes it simple, fast, and hassle-free to simply upload proof of your home address. We check your details against the address you’ve given, so confirmation can be automatically sent out to your conveyancer or estate agent.

That means you’ll be closing your deal before you know it.

Financial history

Prove your money is legitimate

Estate agents want to know you’re trustworthy, and with Checkboard all you need to do is upload documents proving your source of funds, and you’re on your way.

This helps you prove your income has come from a legitimate source, and that you’re reliable when it comes to making payments on your rent or mortgage.

Secure payments

Make payments quickly and securely

Safely and speedily make instant payments through Checkboard's secure open banking platform.

Pay important fees with confidence, including through credit/debit cards, Apple Pay, Google Pay and other options.

Track your finances across your lifetime

Checkboard isn’t just about closing the deal – it’s your lifetime partner for tracking your finances and managing your credit score.

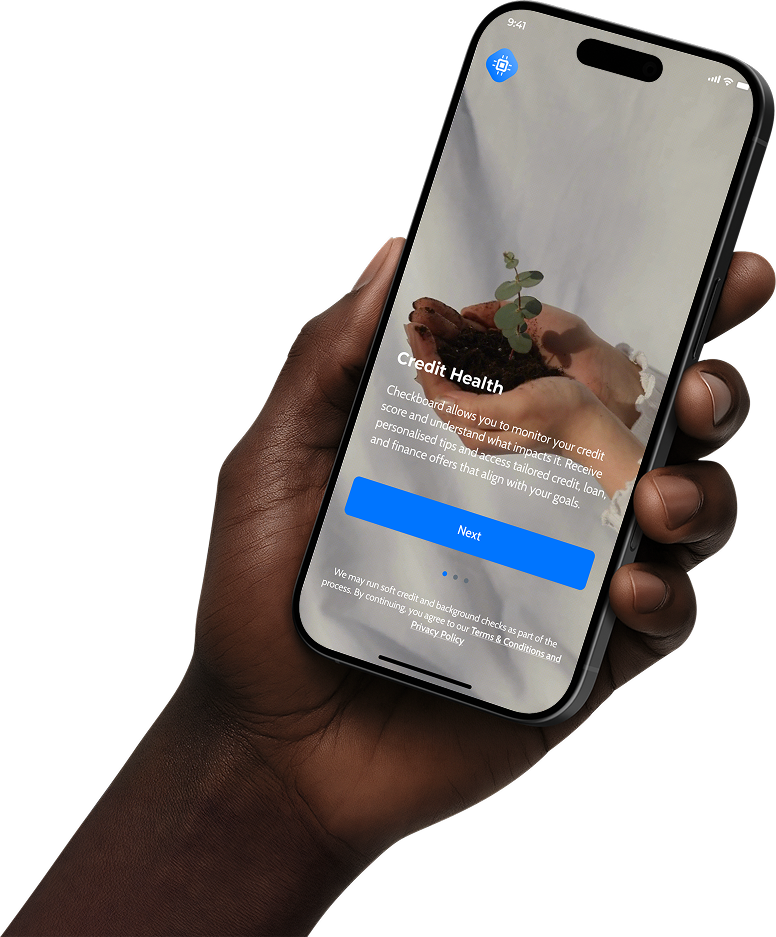

Credit scoring

Keep track of your

credit score

Never lose track of your credit score with a simple overview and practical advice, so you’ll know how likely you are to approved for a loan or mortgage.

Track your spending

Get an overview of your finances

Connect all your accounts through safe, secure open banking, and get a clear overview of your finances, so you can track your outgoings across multiple accounts.

Personalised offers

Discover personalised offers

Checkboard helps you qualify for credit and financing by sending you personalised offers according to your credit score.

Questions? Answers.

Can't find what you're looking for? Check out our full documentation.

Checkboard acts as a credit broker, not a lender. This means we help connect you with suitable credit providers but do not issue loans ourselves.

We partner with Monevo, a regulated broker with access to a panel of lenders. If you’re eligible, Monevo will show offers from their lending partners based on your credit profile.

No. We only perform soft credit searches when assessing eligibility, which do not impact your credit score. If you proceed with a lender, they may conduct a hard search, which could appear on your credit file.

No. The lenders available through our service may also be accessible through other brokers or directly. Using Checkboard does not restrict your ability to apply elsewhere.

Checkboard is authorised and regulated by the Financial Conduct Authority (FCA) to provide credit broking services. Our FCA reference number is 950508.

PCIS stands for Providing Credit Information Services. These are services regulated by the FCA that allow consumers to access and monitor their personal credit information. They are distinct from broader credit referencing or broking activities.

Credit monitoring lets you track changes to your credit report, such as new accounts, missed payments, or shifts in your credit score. This helps you detect fraud early and maintain strong credit health.

Our PCIS offering provides:

- Access to your credit report

- Regular alerts about key changes

- Tools to help you understand and improve your credit standing

- A secure dashboard to view your credit profile

We use data from Equifax to ensure accurate and up-to-date reporting.

We take complaints seriously. If you’re not satisfied with our service, please contact us via [email protected]. If you're still unhappy, you can escalate the matter to the Financial Ombudsman.

Absolutely. All our communications comply with FCA rules, including the CONC (Consumer Credit Sourcebook) and requirements that promotions be fair, clear, and not misleading.

Disclaimer: Checkboard is a credit broker not a lender.