Simplify compliance with an all-in-one AML solution

Keep track of your clients’ financial history, and perform fast and accurate AML and source of funds checks, so your firm can stay on top of your compliance burden.

Fast and compliant AML

Conduct fast, simple AML checks to keep on top of evolving regulations.

Ongoing monitoring

Proactively screen clients across PEPs, sanctions, and adverse media lists.

Biometric & ID verification

Get accurate and reliable KYC with face match, liveness checks, and ID scans.

Source of funds checks

Perform fast and accurate source of funds checks through open banking

TRUSTED BY REGULATED COMPANIES ACROSS THE UK

Join the growing number of firms boosting their AML compliance with Checkboard

SUPPORTING YOUR TEAM WITH EFFORTLESS COMPLIANCE

Why financial services trusts Checkboard

PEPs and sanctions screening

Stay compliant with real-time updates

Stay on top of strict financial regulations with real-time monitoring of PEPs, sanctions, and adverse media lists. Get instant alerts and actionable insights to respond to red flags as they emerge.

Consumer credit data

Assess your clients' financial health

Reduce your exposure to risk by accessing credit data and payment history through open banking, allowing you to assess the financial health of your clients.

Ongoing monitoring

Identify risks before they emerge

Spot bad actors and money-laundering risks before they impact your business. Reduce manual reviews, save time, and stay ahead of regulations by tracking changes to client profiles in real-time.

EVERYTHING YOU NEED, ALL IN ONE PLACE

Save time and reduce hassle with effortless AML checks on a single, streamlined platform

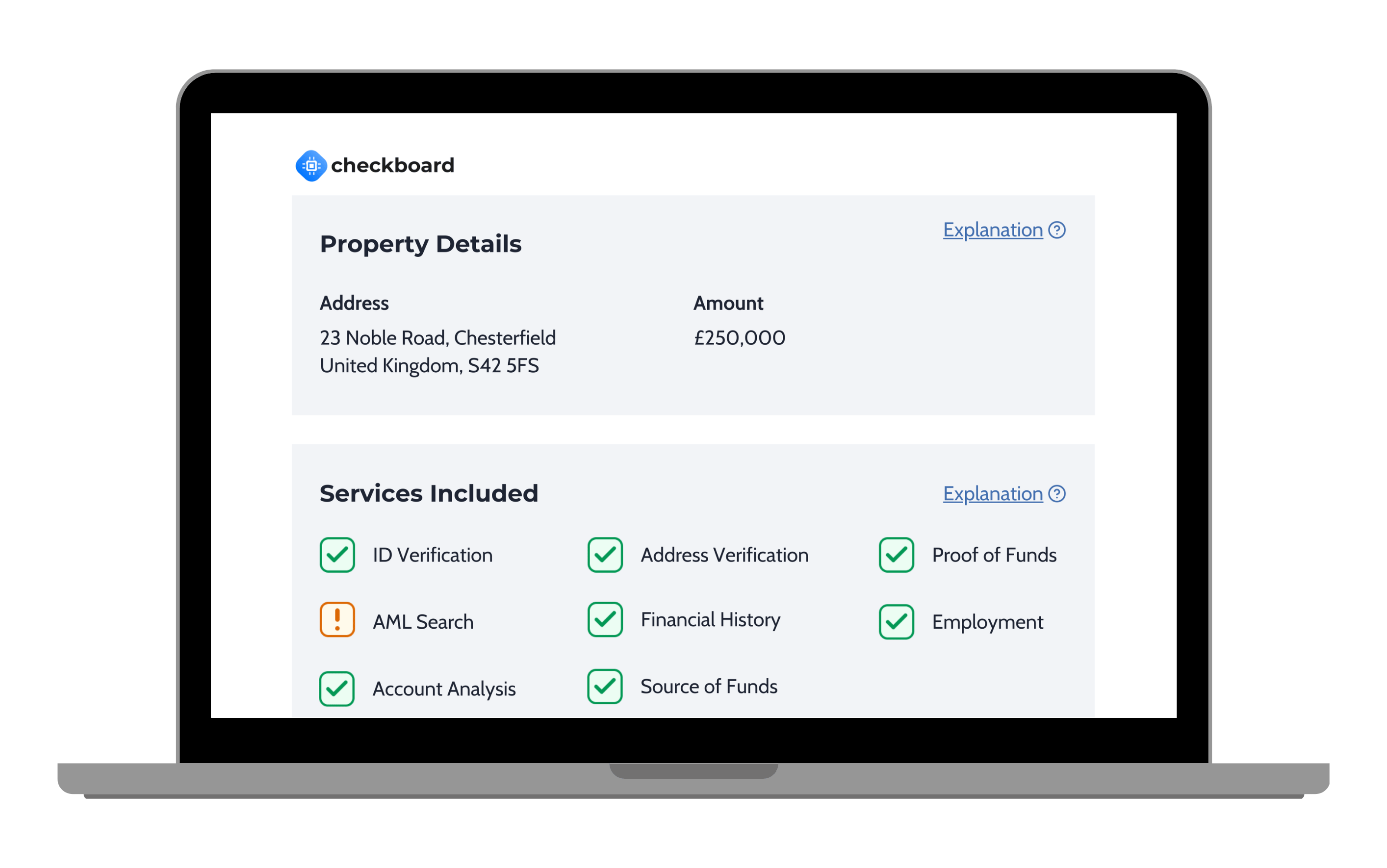

Checkboard Verify

Deliver industry-leading ID and AML checks and ensure full compliance while reducing risk. Our biometric checks meet regulatory standards, with flexible manual options for clients without modern IDs or NFC. Real-time AML screening and automated processes provide fast, accurate results, on an ongoing basis, protecting your company from fraud.

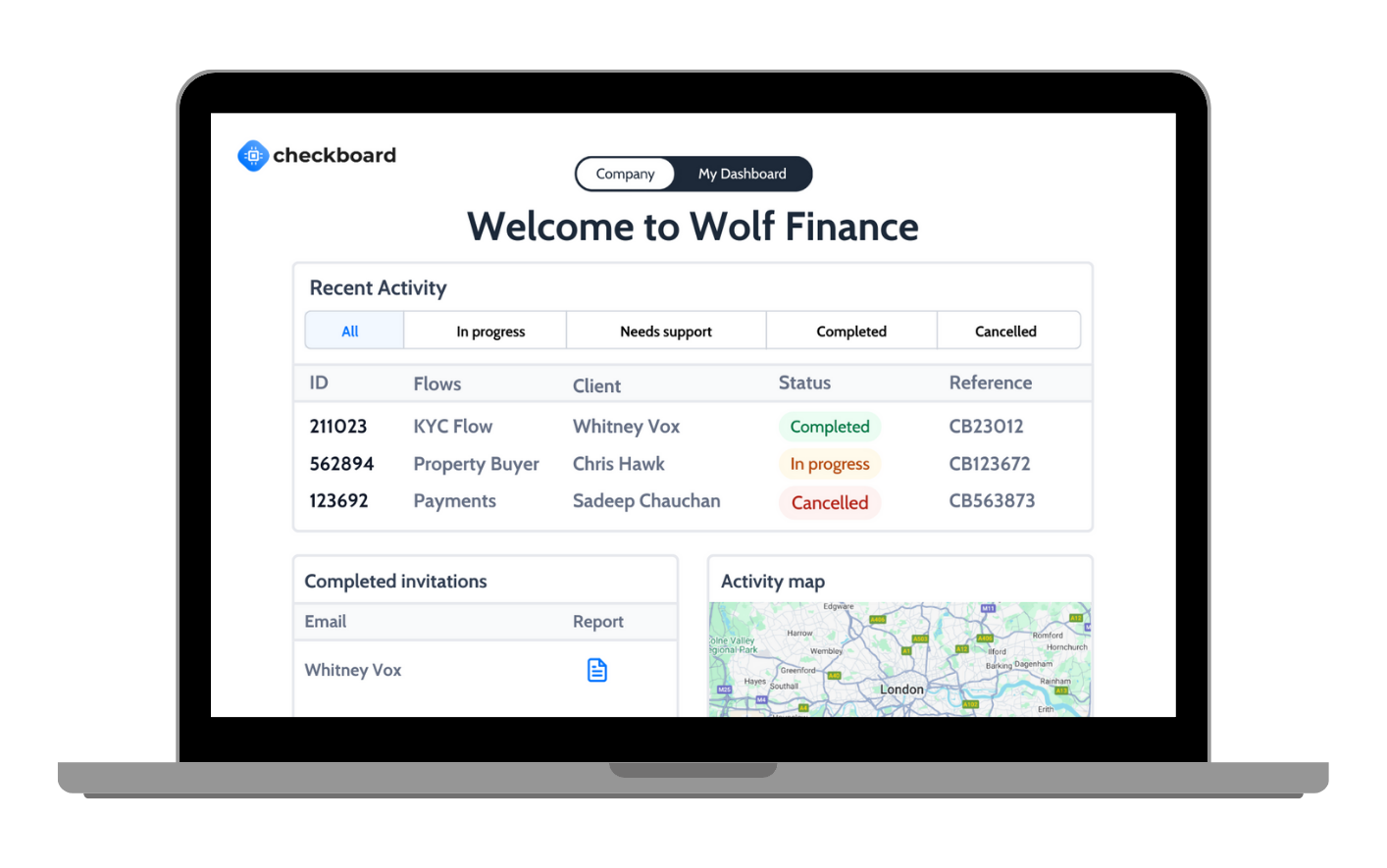

Checkboard Onboarding

It isn’t just AML checks at Checkboard. Run a comprehensive range of workflows tailored to every client type. Send SMS or email invitations in seconds, allowing clients to securely upload ID and documents at their convenience. With a user-friendly interface and no manual follow-ups, onboarding becomes faster, smoother, and more efficient for your team.

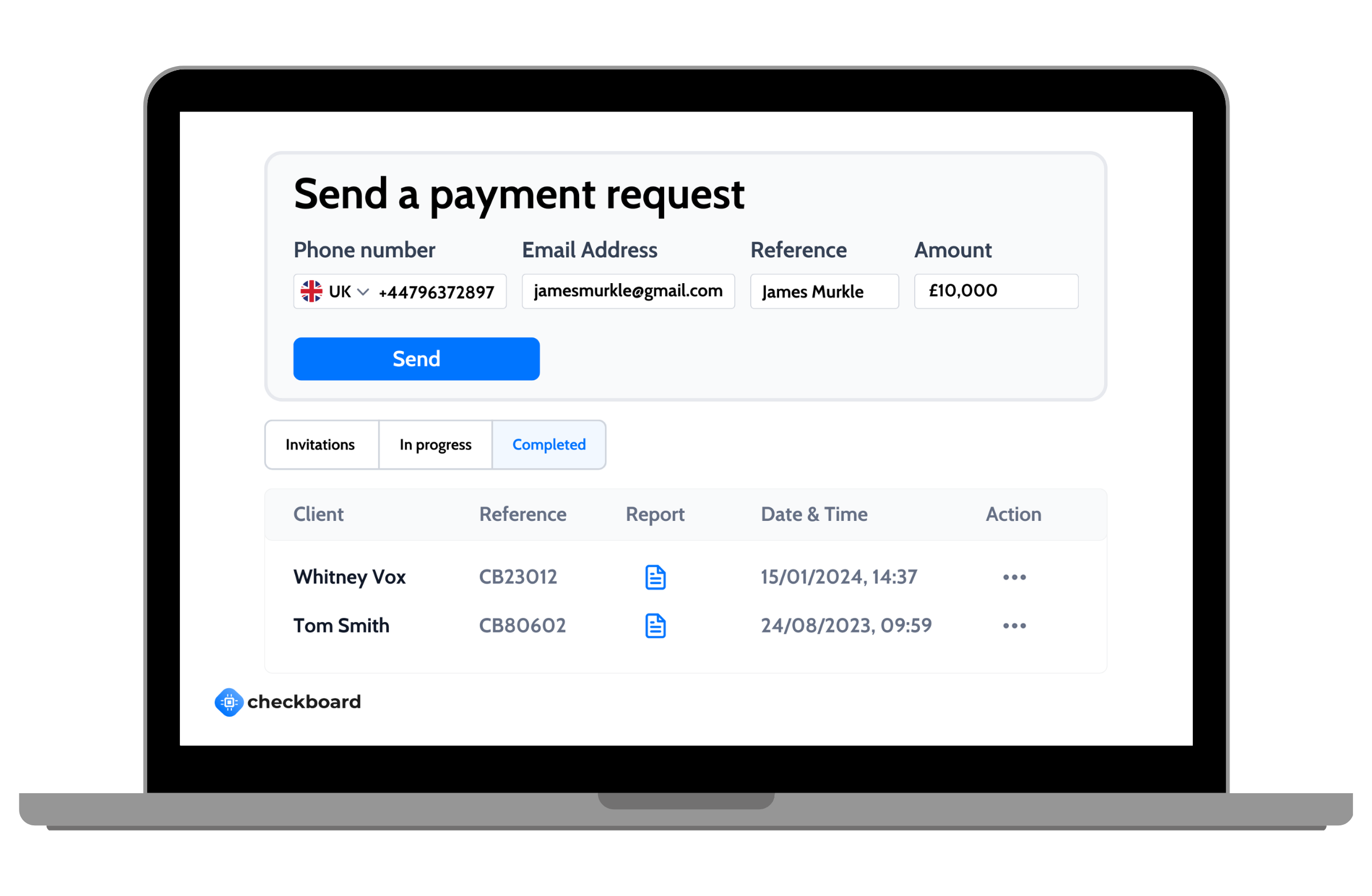

Checkboard Pay

Checkboard doesn’t just onboard and verify your clients, we simplify payment collection up to £1 million. We offer secure processing and automated reconciliation to reduce admin work. Clients enjoy flexible payment options for a seamless experience.

SUCCESS STORIES

Discover what our clients love about

AML checks with Checkboard

Checkboard listened to exactly what we wanted and developed additional requirements to further enhance the client experience. We are happy, but more than that, our clients are very happy using Checkboard, plus customer service is very fast.

Angelo Piccirillo Partner at AVRillo Conveyancing

We chose Checkboard because of their streamlined and efficient approach to compliance checks. Their user-friendly platform integrates seamlessly with our operations, ensuring accuracy, security, and significant time savings.

Sayinthen Vivekanantham Founder of HomeyBUILT FOR SECURITY AND SIMPLICITY

Client verification has never been easier

In-app live support

Get fast, reliable help with an average response time of just 3–7 minutes.

Enhanced security

Eliminate the risks associated with physical documents and unsecured emails downloads.

Aligned branding

Boost your brand identity with a co-branded or fully white-label experience.

PLANS AND PRICING

Tailor the perfect solution to your needs

Lite

Starting from 10 invitations a month, including:

- Biometric ID Verification

- Address Verification

- AML Screening

- Simple Banking Data

- Card Payments

- Pay by Bank

- Standard e-Signatures

- Automated Reminders

Professional

Everything in the Lite plan, plus:

- Land Registry Data

- Banking Data Analysis

- Credit Information

- Biometric e-Signatures

- Adverse Media

- Additional Data Insights

- Ongoing Monitoring

- API Integration

Enterprise

Everything in the Professional plan, plus:

- Custom Transaction Flows

- Manual Invoice Payments

- Dedicated Account Manager

- Priority Support

- Solution Consultation

- End User White-Labelling

- Bespoke Pricing

- SLA Guarantee

TOP-RATED ON THE APP STORE

An effortless, user-friendly app for seamless client onboarding

START YOUR SUCCESS STORY

Fill out this short form, and we'll be in touch to discuss how we can transform your onboarding.

About

Checkboard Limited is registered at Companies House under company number 12243866. It is authorised and regulated by the Financial Conduct Authority (FCA) under firm reference number 950508. If you have a complaint that we cannot resolve, it may be eligible for consideration by the Financial Ombudsman Service (FOS). For more information, please visit the Financial Ombudsman Service

website.

Security & Compliance

Checkboard has been assessed and certified as meeting the requirements of ISO/IEC 27001:2022. This certification demonstrates our commitment to industry-leading information security practices. Certification applies to our information security management system (ISMS) and not to individual products or services.

You can verify the validity of our ISO certificate by entering our certificate number 265514 via this link.

Checkboard © 2025. All rights reserved.

Checkboard has fulfilled our onboarding and AML needs perfectly, exceeding our expectations, whilst saving a significant amount of time, money and cost when completing due diligence.

Ben Monksummerm Partner at Harris & Harris