How to remove friction between your solicitors and accounts teams

Are disconnected platforms causing frustration for your different teams?

If you’re using one system for onboarding and another for payments, you’re creating friction between your conveyancers and your accounts department. It means you’re spending too much time manually linking client accounts that could be better spent serving clients and growing the business.

So, what’s the solution?

With Checkboard, you get a platform that does the lot: AML checks, ID and address verification, and payments. All this is combined on a single dashboard, so different teams get total visibility over everything they need to see.

And more importantly, it gives your team back time better spent elsewhere.

Secure payments keep your accounts team happy

Checkboard’s payment solution is fast, simple, and secure.

Payments can be enabled in several ways: through a payment gateway on your own website; manually over the phone; or using the Checkboard app. It’s simple, intuitive, and easy to integrate using APIs with your existing workflows.

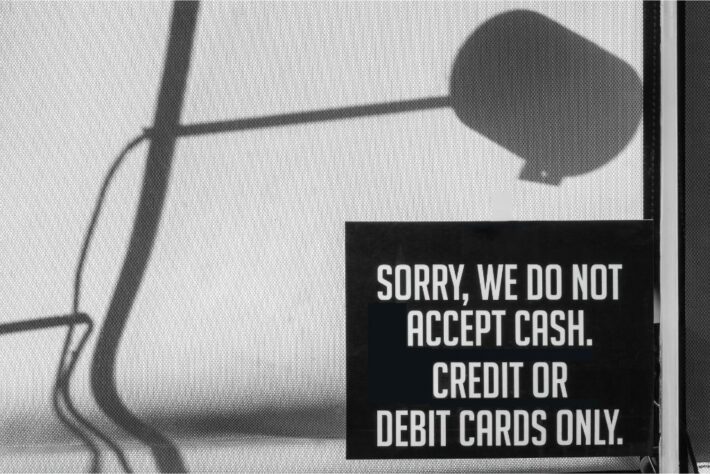

Clients can pay through credit and debit card, Apple Pay, Google Pay, and through bank transfer, giving them a number of seamless options.

What’s more, payments are capped at £1 million, giving you and your clients plenty of breathing room for even the largest charges.

Importantly, payments can be requested as part of the onboarding process. If, for instance, clients are using the Checkboard app to upload ID documents or proof of funds, they can be immediately directed to make a payment.

Linked to a single dashboard, this means proof of payment is visible alongside their ID verification or AML checks.

It gives conveyancers and finance teams alike visibility over the whole process, making onboarding a faster and more seamless process.

How to keep your payments compliant

These payments are all made in a secure, compliant environment. Part of the reason for that is Checkboard’s robust approach to source of funds checks, which can be run as part of any client relationship.

These checks allow you to reduce your exposure to risk and comply with money laundering regulations, giving you confidence that any payment is coming from a trustworthy source.

All this is enabled through open banking, which helps you:

Conduct fast proof and source of funds verification

Confirm source of funds from gifts, mortgages, savings, and co-buyers

Detect suspicious deposits, such as from gambling and crypto

What’s the benefit to your team?

Onboarding can be a long process. Thanks to Checkboard, you can remove some of the friction and some of the stress for clients and conveyancers alike.

Instead of sending your clients multiple links to complete each step of the workflow, you can direct them to download the Checkboard app and complete the whole process in one go.

And because onboarding can’t be completed until a payment is made, it means you no longer have to spend weeks chasing a client for overdue charges.

This makes onboarding quicker, increases client satisfaction, and makes life easier for your whole team.

Get in touch to discover faster payments and connected systems.