How legal firms can avoid facilitating money laundering

Legal professionals are inadvertently facilitating money laundering.

The government calls these “professional enablers” – individuals or organisations that have failed, whether by negligence or deliberate action, to do their due diligence.

Conveyancing, trusts, and management of client accounts are considered the most high-risk areas for money laundering due to the large sums of money involved. Compliance professionals dealing with those areas thus have a heightened responsibility to manage that risk.

Tackling this unwitting source of money laundering is also part of the government’s Economic Crime Plan, adding another impetus for firms.

Where is enablement occurring?

Typically, enablement slips through the cracks of poor due diligence, when compliance officers have taken their eyes off the ball. It can be found in:

Inadequate risk assessments that start and end with ID verification

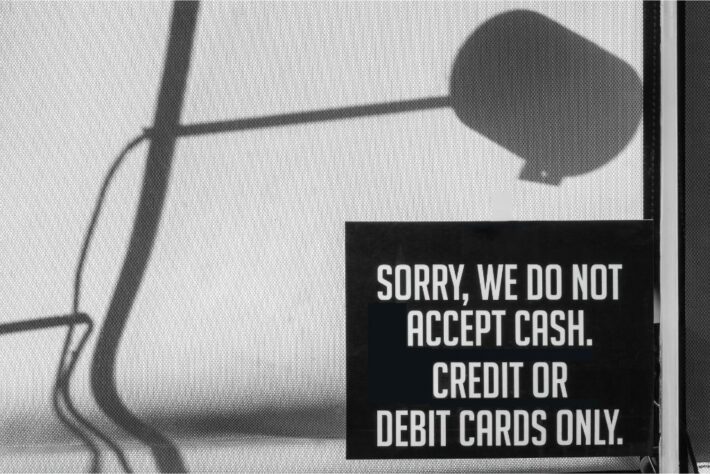

Large cash or crypto transactions that are harder to trace

Complex legal arrangements used to disguise the source of funds

Enablement can also be deliberate. In a small number of cases, it is compliance officers themselves who are allowing suspicious transactions and unusual shell companies to go unnoticed.

Legal firms that fail to spot red flags are unwittingly exposing themselves to enormous risk – both financial and reputational. This can lead to unwelcome visits from the auditors, and potential fines.

How firms can improve their AML processes

It starts with improved staff training and robust anti-money laundering policies. Staff – not just compliance leaders – must take ownership of AML and remain vigilant for the signs of risk.

They must also learn to apply due diligence across the entire client lifecycle. Even seemingly legitimate clients can become a threat somewhere down the line. Red flags can all too easily be missed when compliance officers are looking elsewhere.

There is already extensive guidance and best practice available to firms looking to tackle money laundering. Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 recommend training, a business-wide risk assessment, up-to-date policies, and comprehensive client due diligence.

But it’s technology that holds the key. Applied correctly, a compliance platform that proactively screens for risk will help firms identify red flags before the danger emerges.

Where technology comes in

A technology platform like Checkboard goes beyond basic identity checks. While AML always starts with ID verification, Checkboard extends due diligence across the entire client relationship.

It helps firms stay on top of AML compliance with real-time monitoring of PEPs, sanctions, and adverse media lists. It automatically flags potential areas of risk, so firms can respond proactively, rather than simply clean up the mess after the money laundering has already taken place.

And by enabling comprehensive source of funds checks, Checkboard can help firms flag suspicious transactions with dubious origins, such as cash or crypto.

In that way, organisations can play a role eliminating the risk of money laundering. This helps them avoid regulatory attention, large financial penalties, and reputational damage.

But technology like Checkboard also helps eliminate negligence – unwitting or otherwise – from causing problems. Automatic alerts across every stage of the client lifecycle are harder to ignore.

A version of this article was originally published on Legal Futures.