How to use enhanced data insights for a better ID check

When you perform an ID check for a new client, many of you will be used to sifting through reams of paperwork to extract addresses and personal details. It’s a slow, laborious process, but for a long time it produced results.

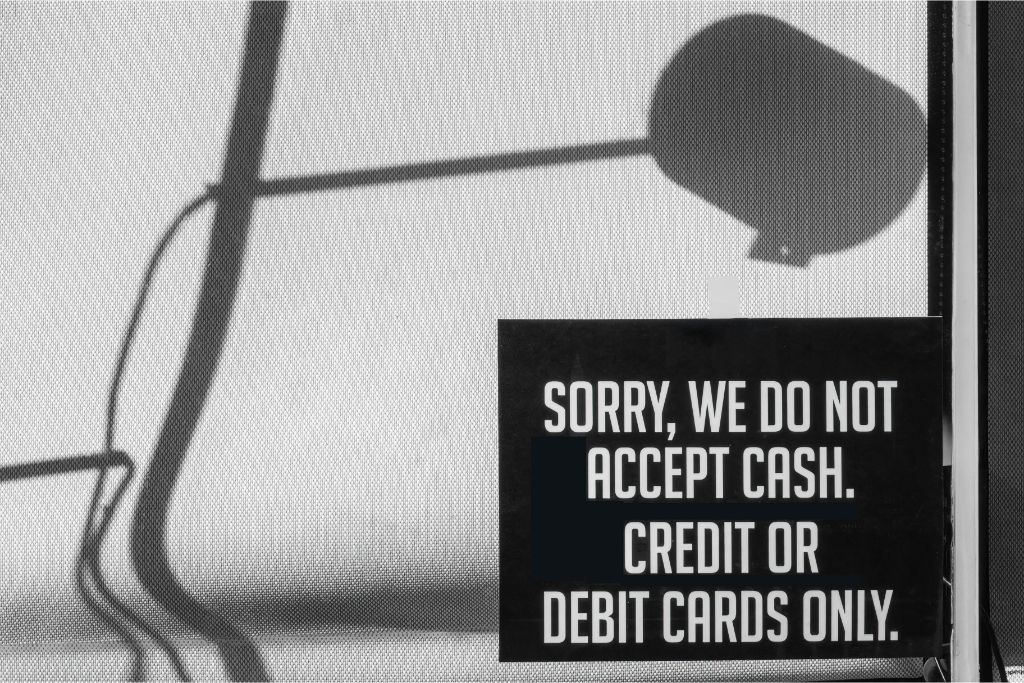

But today, cunning fraudsters are finding new ways to trick you, and the old methods are no longer up to scratch.

The sad reality is you can no longer trust all your clients to provide you with the information you need. In some cases, they’re actually actively trying to fool you: to slip their criminal activity under the radar, hide their associations with sanctioned individuals, or disguise the suspicious origins of their finances.

That’s where Checkboard steps in. We take you beyond documentation, using enhanced data insights to perform a more reliable identity check. That way, we help you reduce your exposure to criminal risk.

How to use data to improve an ID check

As an FCA-regulated institution, Checkboard must meet an incredibly high standard of information security.

This also means we’re approved to hold more information about clients than other providers, and it’s this information, which we acquire through our partnerships with LexisNexis and Equifax, that we can use to make an ID check that much more reliable.

For instance, where many providers rely on manual document uploads and form submissions, Checkboard is able to delve into an individual’s credit report to confirm their identity. Unlike an uploaded ID document or utility bill, which can be clandestinely edited by the uploader, a credit file cannot be tampered with. This makes it much harder for fakes and frauds to slip past your defences.

But Checkboard takes you even further than this, with fast, reliable AML checks, and ongoing monitoring of PEPs, sanctions, mortality, and adverse media lists. This takes place daily over a 12-month period, meaning you can spot red flags and inconsistencies even after the onboarding is complete.

You can cross-reference all this against other forms of ID and address verification, and therefore get the fullest possible picture of your new client.

ID checks sent straight to your dashboard

With Checkboard, waiting for document uploads and chasing clients becomes a thing of the past. You have instant access to reliable information from one of the world’s most trusted credit agencies, sent straight to your dashboard.

At a time when fake identities are getting easier to create, having a robust approach to identity verification is more important than ever.

Not only does it help you meet your reporting obligations, it also protects your firm from criminal risk. This has the twin effect of helping you avoid regulatory attention and improving your reputation with clients.

So, using these enhanced insights is good for keeping the auditors off your back, and it’s good for business, too.

A version of this article was originally published on Legal Futures.