What’s the difference between KYC and KYB?

There is a vital set of practices all entities must adhere to, whether they’re big banks or burgeoning startups. Those practices are called Know Your Customer (KYC) and Know Your Business (KYB). But what exactly are these concepts, and why are they so crucial? Let’s decipher these compliance codes together, without rattling your brain with too much jargon.

What are KYC checks?

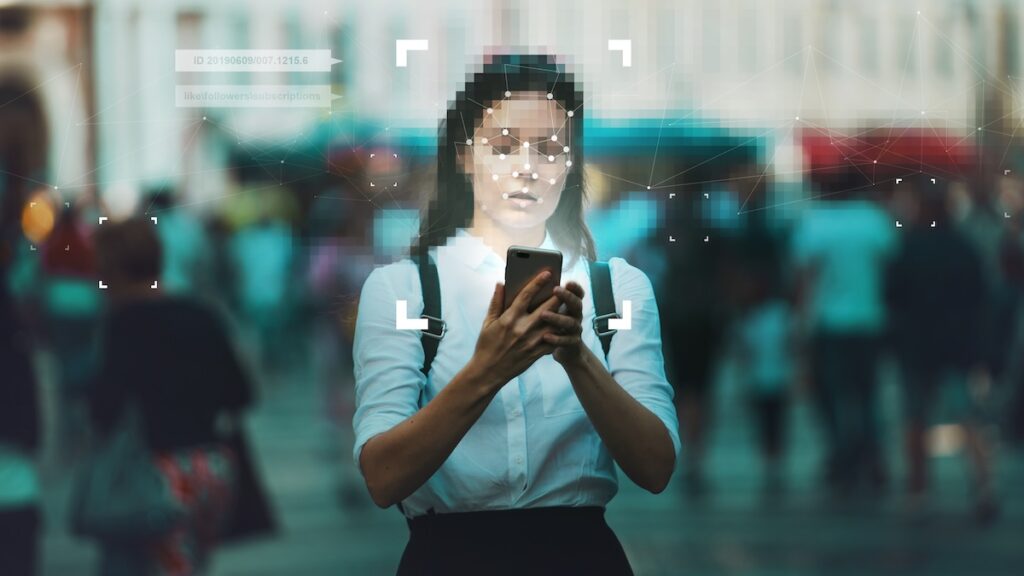

At its core, KYC is the process by which businesses verify the identity of their clients. It’s akin to a club bouncer scrutinising your ID before letting you in — except instead of checking your age, financial institutions are verifying you are who you claim to be, assessing the risk of doing business with you, and ensuring you’re not involved in any untoward activities, like money laundering or funding the bad guys.

Here’s how it breaks down:

- Identity verification: Just as it sounds, it involves checking your government-issued documents to ensure you’re legitimate

- Risk assessment: Businesses will have a gander at your financial profile to understand the risk they’re taking on. High-risk individuals are monitored more closely

- Ongoing monitoring: It’s not a one-and-done deal. Businesses keep an eye on transactions to make sure everything’s above board as time goes on.

Why are KYC checks important?

Simply put, KYC measures keep the financial system clean by adding layers of security. It prevents identity theft, guards against financial fraud, and supports anti-money laundering efforts (AML). For you, the customer, it means a safer and more trustworthy financial environment.

What are KYB checks?

KYB is the sibling of KYC, targeting the validation and verification of businesses instead. If KYC is the club bouncer checking your ID, KYB is the detective doing a background check on the club’s owners.

- Business Identity Verification: This ensures that the business exists beyond just a website or business card — think verifying addresses, registration documents, and legal files

- Understanding Business Structure: Who’s in charge? The process identifies the key individuals pulling the strings, often known as ‘beneficial owners’

- Regulatory Compliance: Businesses need to play by the rules, and KYB makes sure they aren’t cutting any regulatory corners.

What is KYB important?

KYB isn’t just about dotting i’s and crossing t’s. It’s about creating a transparent business environment where companies are held accountable. It’s particularly essential for other businesses that might enter partnerships or conduct transactions with them.

What's the best practice for KYC and KYB?

In today’s interconnected and online world, KYC and KYB aren’t just good practice – they’re essentials. They serve as safeguards, assuring that honest individuals and businesses can go about their affairs without the fear that they might be transacting with a shell company or falling victim to identity fraud. Compliance might not be the most thrilling topic, but it’s the unsung hero keeping the financial highways ethical and protected.

For individuals and businesses alike, KYC and KYB procedures represent a commitment to security in an often unpredictable market. They may require a bit of paperwork and patience, but knowing that these measures are fighting on the frontline against financial crimes should bring a sigh of relief.

So, next time you’re filling out a form or presenting various documents to start a new account or business relationship, remember: these are the nuts and bolts keeping the machinery of the economy safe and sound for everyone. Stay informed, cooperative, and rest easy knowing that with KYC and KYB, trust and security are the names of the game.

Interested in learning more about KYC and KYB procedures? Get in touch with Checkboard today.