Case Study: How Homey achieved lightning-fast conveyancing

Homey connects solicitors and estate agents on one platform, powering lightning-fast conveyancing. It aims to make the entire conveyancing process fast and efficient, eliminating admin and automating workflows.

We spoke to Homey’s CEO and founder Say Vivekanantham to find out how Checkboard’s approach to compliance checks has helped them serve their clients faster and more efficiently.

The challenge: Something that says “Homey”

As conveyancers, Homey are obliged to perform a series of compliance checks for every client: AML checks, ID verification, and source of funds checks.

For many firms this is a slow process, but Homey’s ethos is “lightning transactions”, so it needed a technology partner that could help it become ultra-fast and highly efficient. “That’s our slogan. We need things to happen at lightning speed – and that’s the same thing we expect from our partners as well,” said Say.

But for Homey, speed had to be paired with the flexibility to serve a diverse client base, one that includes less tech-savvy individuals. “In conveyancing many of the customers who are selling properties are quite old and not very tech savvy, so having the feature to manually perform checks for them would place us in the clients’ good books.”

All this had to be done under the Homey banner, so rather than adopting a one-size-fits-all tech solution, it wanted to create its own white-label app: a Homey-branded experience with a reliable, flexible engine under the hood. “We wanted something that was unique to us, something that says “Homey”, so clients don’t get confused and we keep everything within the Homey umbrella.”

The solution: Fast workflows, accurate reports

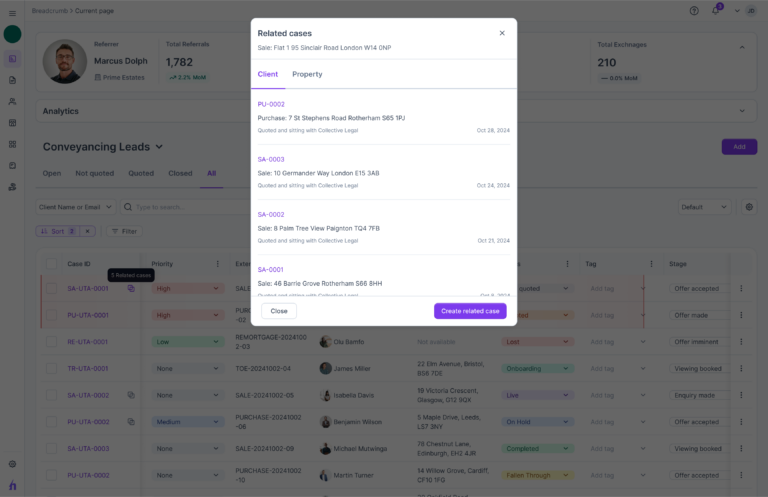

Checkboard helped Homey keep everything within its own brand by creating a white-label app. Checkboard’s fast, seamless, and accurate checks and reports stayed the same, but it allowed Homey to gather targeted data with its own logo front and centre.

By connecting Checkboard’s API with Homey’s, the app could be seamlessly integrated with Homey’s own system, allowing it to automatically pull reports from one to the other.

As soon as a client completes the check on the app, Homey’s solicitors and agents have immediate access to the data; they can download the report at the click of a button. “The process and the flow is really fast. The solicitors are really appreciative when they can quickly pull through accurate reports,” said Say.

As a result, Checkboard covers Homey’s AML checks, ID verification, source of funds checks, and customer service. “It’s more than the complete package,” added Say. “The ID checks and customer service is provided by Checkboard, but we have our own white-label system and a dedicated support team. It really does make us different from a lot of other conveyancing companies.”

The results: Solving problems

The impact has been clear. Conveyancing depends on running accurate ID and AML checks, and Checkboard has made the process fast and seamless, providing accurate, up-to-date data. “When it comes to conveyancing, it’s the time factor that’s important,” said Say. “In terms of capturing the names, the data is quite up-to-date; I’m not sure if other providers can provide that level of accuracy.”

Homey has also leveraged Checkboard’s other functions, including manual ID checks to better serve less tech-savvy clients.

And all this has been backed up by the highest level of support. Homey’s onboarding team works closely with Checkboard’s support team to solve problems and eliminate friction. “We like reaching out to Checkboard and solving problems for our clients. There have been certain instances where the client forgets to press the submit button or something like that – and Checkboard really pulls through.”

As for the future, Homey continues to see Checkboard as a valuable partner. “We’re getting more people, more agents, and more law firms to sign up, and that means more and more ID checks. We’re only looking to grow, and we’re looking to grow with Checkboard as our partner,” said Say.

Interested in finding out how Checkboard can help your firm? Get in touch today.