What is a biometric ID check in conveyancing?

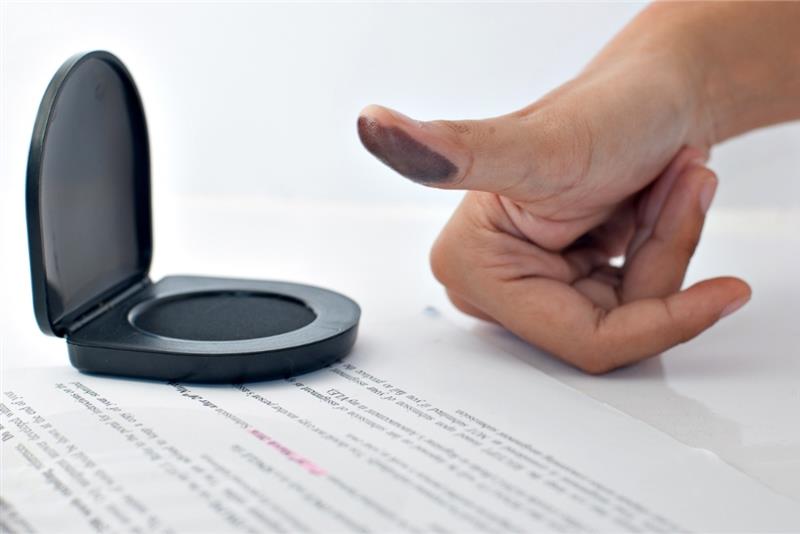

Biometric data refers to the biological measurements used to identify a person. These biometric features include fingerprints, facial recognition, and retina scans, but blood type, gait, and even the way you smile can be unique identifiers. You probably encounter some of these identifiers daily simply when you’re unlocking your phone.

Face and fingerprint scanning are commonplace across our devices, adding an extra layer of security – usually in conjunction with passwords or PIN codes.

But biometric ID verification is now increasingly used by conveyancers, law firms, estates agents and other professions to confirm the identity of their clients.

Biometric ID check

Biometrics are a new and powerful weapon in the fight against money laundering.

With a biometric ID check, UK firms are better meeting their obligations under the Anti-Money Laundering Act 2017. Facial recognition combined with NFC passport checks, for instance, adds a new level of certainty and security to the way firms conduct identity checks.

Facial recognition in particular is a simple and extremely secure way of confirming a person’s identity by comparing it against a valid ID document. For regulated businesses, biometric data is a useful tool for conducting liveness checks, and therefore for protecting themselves against fraud, and identity verification providers are beginning to meet that need.

Ongoing confirmation

In addition, biometric authentication confirms returning users are who they claim to be.

The Checkboard app supports biometric identity verification through facial recognition on iOS, Android, and through APIs.

When a user registers on the Checkboard app, they must upload a selfie that is compared against their identity document. Once the user’s selfie has been enrolled, they can use their face to authentic themselves.

Although by no means fool-proof, this is a simple, intuitive, and accurate method for conducting ongoing identity verification, with a strong track-record of preventing identity fraud through the app.

NFC passport check

Comparing a selfie against an ID document is all well and good, but it doesn’t necessarily protect a business from identity fraud using falsified documentation.

But today, safeguards are in place to tackle ID fraud, in particular through the use of NFC chips containing biometric identification in passports.

For conveyancers, the rules are set by HM Land Registry’s Digital ID Standard 2021:

Obtain an ID document with a biometric chip

Confirm the ID is valid, genuine, and up-to-date by conducting a passport scan using NFC technology to extract the biometric information from the chip

Conduct a liveness check and cross-reference that against the photo stored on the biometric chip

Obtain evidence to ensure the client is the legitimate property owner, for example through a mortgage statement or council tax bill.

By cross-referencing a user’s facial recognition data against the biometric information contained with the passport, conveyancers can more confidently confirm an individual’s identity. This substantially reduces their exposure to criminal and financial risk.

The Digital ID Standard also protects the conveyancer from liability: if a firm meeting these standards later discovers the client was committing identity fraud, HMLR will not seek legal recourse.

Secure through biometrics

Many conveyancing firms will historically have relied on simply uploading scans of ID documents and council tax bills to confirm a client’s identity. This may have been enough twenty years ago, but in an increasingly uncertain world, extra layers of protection are required.

Checkboard’s biometric ID check gives firms the confidence and peace of mind to rapidly onboard new clients safely and securely. This ensures they are reducing their exposure to risk and meeting their obligations under anti-money laundering standards.